Annualised wage arrangements – changes commence 1 March 2020

The Fair Work Commission has determined that revised annualised wage provisions will be inserted into a number of modern awards from 1 March 2020, including the Clerks – Private Sector Award 2010 and Manufacturing and Associated Industries and Occupations Award 2010.

Employers that utilise an annualised wage arrangement under a modern award will be required to notify employees of how the annualised wage has been calculated, keep additional records and conduct annual audits.

However, employers are not compelled to enter into an annualised wage arrangement under a modern award and may instead continue to use common law offsetting provisions contained in an employment contract. That is, employers are able to determine whether entering into annualised wage arrangement under a modern award is appropriate for their business.

In light of the recent spate of high profile underpayment cases, including a number involving incorrectly calculated annualised salaries, it is important for employers to understand their obligations and ensure they are compliant.

New annualised wage provisions

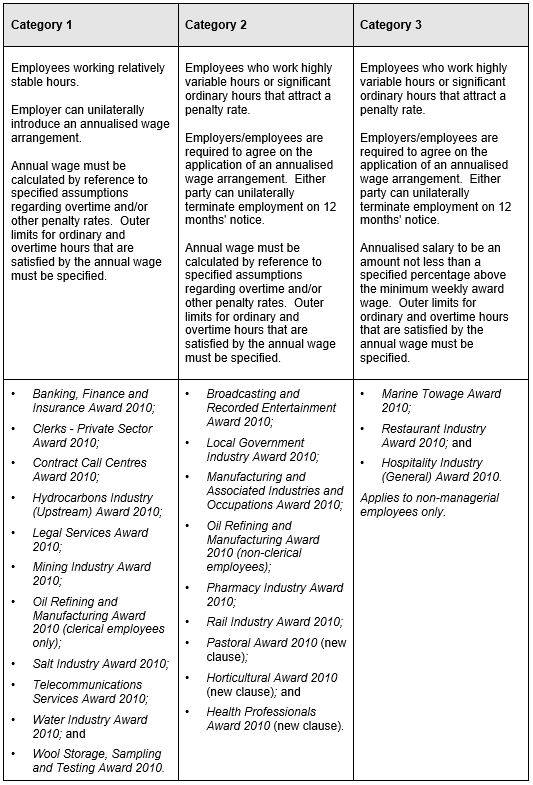

The Fair Work Commission has settled on three model clauses to be inserted into three categories of modern award (see our table setting out the applicable modern awards below). Each of the new clauses requires employers to:

- Notify – advise employees and keep a record of which provisions of the modern award have been satisfied by the annualised wage, and in some cases set out the methodology of calculating the annual wage, including overtime and penalty rate assumptions;

- Set outer limits – advise employees and keep a record of the “outer limit” number of penalty rate hours and overtime hours, which are built into the annualised salary;

- Keep records – keep records of each employee’s starting and finishing times as well as any unpaid breaks taken by the employee. In addition, the record must be signed by the employee, or acknowledged as correct in writing (including by electronic means), each pay period or roster cycle; and

- Conduct an annual reconciliation – calculate the amount of remuneration that would have been payable to the employee under the terms of the modern award and compare this to the wage actually paid, on a 12 monthly basis or on termination of employment. Where an employee has been paid less than their minimum entitlements under the relevant modern award, the employer must rectify this within 14 days.

The three model clauses differ in the following ways:

- for the model clauses for awards in categories 2 and 3 (see below), employee agreement is required and either party is able to unilaterally terminate the arrangement with 12 months’ notice. For the model clause for category 1, no such agreement is required and there is no unilateral right of termination; and

- the method of calculation also differs. Model clauses for categories 1 and 2 require the employer to calculate the annualised wage by reference to overtime and penalty rate assumptions, with the employer required to specify the outer limit of ordinary hours that would attract a penalty or overtime rate. Whereas with the model clause for category 3 awards, wages are calculated by a minimum percentage uplift on the minimum annual wage, with outer limits also being specified.

At this stage, the new annualised wage provisions only apply to full-time employees.

Contractual offsetting

Employers are not obliged to enter into an annualised wage arrangement under a modern award and may continue to rely on offsetting provisions in an employment contract. Employers should consider their own circumstances and whether an annualised wage arrangement under a modern award would be a desirable option for them.

At a minimum, employers are required to pay employees their minimum award entitlements in each specific pay period or roster cycle (usually weekly, fortnightly or monthly depending on the relevant award). If an employee’s annual wage is sufficient to cover their minimum entitlements in each pay period under the modern award, there may be little utility in entering into an annualised wage arrangement under a modern award. Instead, an offsetting clause in an employment contract may provide adequate protection for employers.

However, where the amount of penalty rates or overtime hours worked by an employee fluctuate across the course of the year, it may be that in particular pay periods the employee’s wage is not sufficient to cover minimum award entitlements and in other pay periods they may receive a wage in excess of their minimum award entitlements. In this scenario, the annualised wage provisions in modern awards allow an employer to look at an employee’s wages across the course of a year, without fear of an award breach for not paying the employee’s minimum entitlements in any particular pay period. Of course, where the employee’s wage is less than the employee’s minimum entitlement at the end of a particular year, the employer is required to rectify any shortfall following a yearly reconciliation.

Employers must consider their current arrangements and which option is best for their business.

Record keeping

In all cases, employers must comply with record keeping obligations under the Fair Work Act 2009 (Cth) and Fair Work Regulations 2009 (Cth). In addition, for employers entering into annualised wage arrangements under a modern award, employers are required to record employee starting and finishing times and unpaid breaks, which must be signed or acknowledged as correct by employees in each pay period.

What do employers need to do?

Employers need to consider whether to enter into an annual wage arrangement under a modern award or rely on offsetting provisions in an employment contract. Either way, employers must understand what entitlements are built into annual salaries. A “set and forget” approach is untenable.

All annualised wage arrangements must be supported by robust and well-drafted employment contracts. Employers also need to have in place good systems for record keeping and, if entering into an annualised salary arrangement under an award, yearly reconciliations.

This is a complex area and failure to comply can result in significant financial and reputational consequences.

Gadens is well placed to assist employers to understand their obligations and implement supporting employment documentation.

Authored by:

Steven Troeth, Partner

Emma Moran, Senior Associate

Katie White, Lawyer