Reminder and ASIC practical guidance regarding important amendments that apply to financial advisors and clients regarding their ongoing fee arrangement obligations

The obligation to give clients a fee disclosure statement (FDS) annually where there is an ongoing fee arrangement has applied since 1 July 2012. From 1 July 2021, two broad additional obligations have applied between both advisors and clients where there is an ongoing fee arrangement (OFA) in place.

These additional obligations were introduced by the enactment of the Financial Sector Reform (Hayne Royal Commission Response No. 2) Act 2021 (Cth), amending provisions under the Corporations Act 2001 (Cth). Importantly, these two additional obligations are for fee recipients: (a) to renew an ongoing fee arrangement on an annual basis and (b) to obtain a client’s written consent to deduct ongoing fees from a client’s account.

1. The OFA Obligations

A fee recipient who enters into an ongoing fee arrangement with a client must, each year, comply with the obligations in Division 3 of Part 7.7A of the Corporations Act 2001 (Cth) (CA). These obligations include:

- seeking the client’s renewal of the ongoing fee arrangement annually;

- giving the client a FDS annually where there is an ongoing fee arrangement; and

- obtaining the client’s written consent before they can deduct, arrange to deduct, or accept deductions of, ongoing fees from the client’s account.

In this article, these requirements are referred to as the ‘OFA obligations’.

2. Who must comply with the OFA obligations?

Fee recipients must comply with the OFA obligations. A fee recipient is: (a) an Australian financial services (AFS) licensee or its representative who enters into an ongoing fee arrangement with a client, or (b) if the licensee or representative has transferred (‘assigned’) their rights under the arrangement the person who currently holds those rights (i.e. the ‘assignee’[1]). (A fee recipient may outsource some of its administrative or compliance functions to a third-party agent, but the fee recipient remains responsible for meeting its obligations).

3. When does an ongoing fee arrangement exist?

An ongoing fee arrangement exists when: (a) the fee recipient gives personal advice to a retail client (‘client’); (b) the fee recipient and client enter into an arrangement; and (c) under the terms of the arrangement, the client must pay the fee recipient a fee (however described or structured) during a period of more than 12 months[2]. The following examples are not ongoing fee arrangements: (a) a payment plan meeting the requirements in section 962A(3) of the CA; and an arrangement under which the only fee payable is: (i) an insurance premium[3]; or a product fee[4].

4. What is an ongoing fee?

An ‘ongoing fee’ is any fee (however described or structured) that is paid under the terms of an ongoing fee arrangement between the fee recipient and the client[5]. If a third party pays the fee recipient a fee (e.g. commissions), this will generally not be an ongoing fee, where it is paid under a commercial arrangement between a product issuer or platform operator and a fee recipient. However, commissions may also be considered ongoing fees if they are paid with the clear consent, or at the direction, of the client. Note: ASIC would not generally consider that a commission arrangement is entered into with the clear consent of, or at the direction of, the client merely because it has been disclosed in a Statement of Advice.

5. What are the consequences of not complying with the OFA obligations?

If a fee recipient fails to comply with the OFA obligations, the ongoing fee arrangement will terminate[6]. The fee recipient must not continue to charge ongoing fees after termination of the ongoing fee arrangement. Civil penalties apply to a breach of this requirement[7]. Failure to comply with the obligation to provide an FDS or the obligation not to deduct, or arrange to deduct, ongoing fees without the client’s written consent is also subject to civil penalties[8]

6. Ongoing fee arrangements to be renewed annually (paragraph 1(a) above)

July 2021 amendments provide that a fee recipient must seek client’s renewal of an ongoing fee arrangement annually, rather than every two years[9]. A client may only renew the ongoing fee arrangement in writing and during the ‘renewal period’. The renewal period is defined by law[10] as a period of 120 days beginning on the anniversary day. For example, if the anniversary day is 1 July 2023, the client will need to respond in writing by 28 October 2023 to renew the arrangement.

Clients may renew an ongoing fee arrangement electronically, so long as it is done in writing. For example, the client may: reply via email or SMS confirming that they wish to renew their ongoing fee arrangement; or click a check box on a webpage in response to a statement such as: ‘By ticking the box, you elect to renew the ongoing fee arrangement’. If the client does not renew in the prescribed form, the ongoing fee arrangement will terminate 30 days after the end of the renewal period.

7. Ongoing fee consents required for deduction of ongoing fees (paragraph 1(c) above)

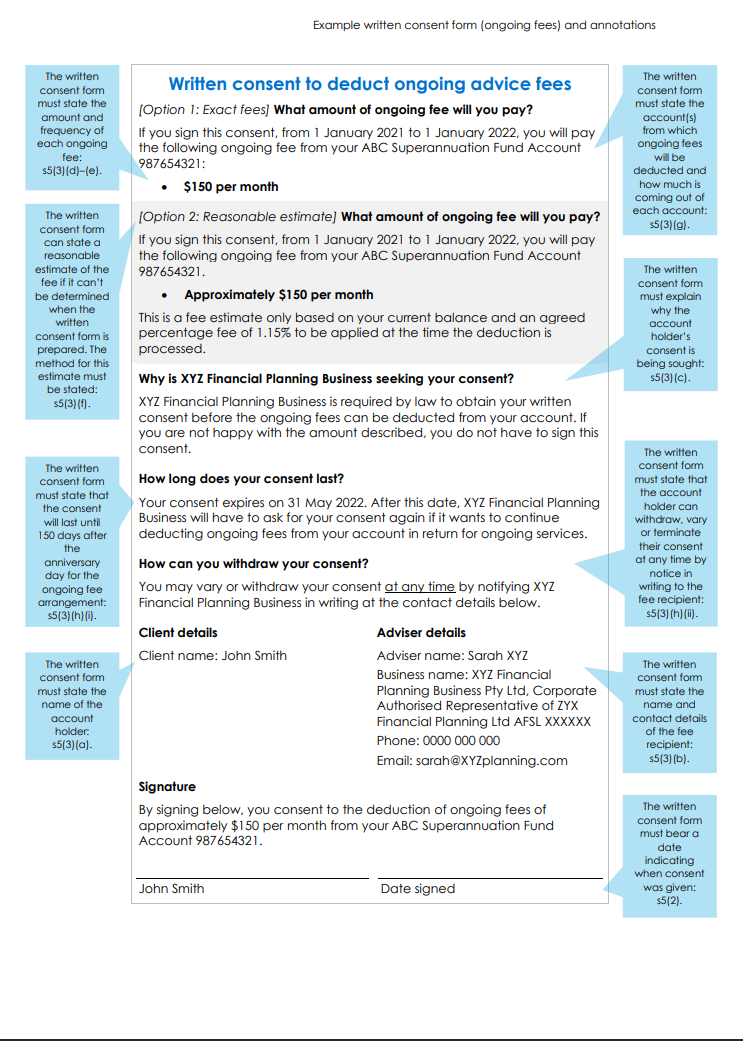

July 2021 amendments also require a fee recipient to obtain written consent of the account holder (i.e. client) before they can deduct, arrange to deduct, or accept the payment of, fees under an ongoing fee arrangement[11]. The written consent must meet the minimum requirements set out in ASIC Corporations (Consent to Deductions—Ongoing Fee Arrangements) Instrument 2021/124. ASIC has provided an example of a written consent form (ongoing fees), extract of which is set out in Schedule 1 to this article (below).

Requirement to obtain written consent

The requirement to obtain written consent applies when: (a) client holds an account with the fee recipient from which they intend to deduct ongoing fees under an ongoing fee arrangement[12]; or (b) client holds an account with a third-party account provider (e.g. a superannuation trustee or responsible entity of a managed investment scheme) from which fee recipient intends to arrange to deduct ongoing fees under an ongoing fee arrangement[13]. Note: where there is more than one account holder (e.g. a couple), all joint holders of the account must give the written consent every year.

This written consent requirement does not apply if the client’s account from which a fee recipient intends to deduct, or arrange to deduct, ongoing fees is an account linked to a credit card or is a basic deposit product[14].

Without limiting the above, it is permitted to seek written consent electronically (e.g. via email or on a webpage).Your client can also sign the written consent electronically by, for example: (a) clicking a check box on a webpage in response to a statement such as: ‘By ticking the box, you consent to the charging of the ongoing fees that are set out in this document’; or (b) sending you their written consent via email with their electronic signature attached.

Third parties

When a third-party account provider (e.g. a superannuation trustee or responsible entity) holds the fee recipient’s client’s account, fee recipient must not arrange to deduct fees from that account unless: (a) they have obtained the client’s written consent to arrange for the third-party account provider to deduct ongoing fees from their account; (b) the written consent meets the requirements in ASIC Corporations (Consent to Deductions—Ongoing Fee Arrangements) Instrument 2021/124; and (c) they have given a copy of the client’s written consent to the third-party account provider.

Deducting, arranging to deduct, or accepting payment of, fees from your client’s account without obtaining written consent is subject to a civil penalty[15]. If a third party is arranging a deduction of fees on behalf of a fee recipient as its agent (or representative), and the client has given consent to the fee recipient to arrange such a deduction, the third party can rely on the consent given to the fee recipient[16].

Where the account to be debited is controlled by a third party, the fee recipient must obtain express written consent to arrange such deduction and provide a copy of the consent to the third party prior to, or as part of, arranging the deduction. If these provisions are not followed and written consent is not obtained, a Court may order the fee recipient refund the amounts deducted to the client.

Variation, withdrawal or termination of consent

OFA’s are not permitted to include conditions that require consent or that do not permit variation or withdraw of client consent. However, an account holder may withdraw or vary consent at any time, by providing written notice to the fee recipient (e.g. by email, text or any other written form)[17]. If a fee recipient receives written notice from the client withdrawing or varying consent, (a) the fee recipient is required to give written confirmation to the client that consent was received within 10 business days; and (b) if consent was provided to an account provider, the fee recipient must also give within 10 business days the account provider a copy of the notice to withdraw or vary consent.

When does written consent cease to have effect?

A client’s written consent will cease to have effect 150 days after the anniversary day, unless the client: (a) terminates the ongoing fee arrangement at an earlier date; or (b) gives a new written consent in relation to the arrangement. At the end of the 150-day period, the fee recipient must: (a) notify the account provider within 10 business days that the consent has ceased; and (b) not continue to deduct, arrange to deduct, or accept the payment of, any further ongoing fees unless they have obtained a new written consent from the client[18].

Fee recipients will also be required to keep appropriate and adequate records to demonstrate compliance as per Division of Part 7.7A of the CA. These records are to be kept for five years and a failure to do so will amount to a criminal offence with a penalty of up to one year imprisonment.

Ongoing fee arrangements that existed before 1 July 2021

For ongoing fee arrangements in force immediately before 1 July 2021, fee recipients must obtain written consent from their client before deducting, arranging to deduct, or accepting the deduction of, ongoing fees under the arrangement, starting from 1 July 2022[19]. For example, if you had an ongoing fee arrangement in place with a client on 1 June 2021, you will need to obtain the client’s written consent for that arrangement from 1 July 2022 onwards.

However, a client can still provide their written consent to a fee recipient for the deduction of ongoing fees from their account before 1 July 2022. If a client chooses to do this, they can withdraw and vary their consent at any time.

8. Update on Fee Disclosure Statements (paragraph 1(b) above)

ASIC made few changes to the requirements within FDSs, simply noting that they can be delivered electronically and include the new consent forms within the same document. The majority of the guidance was around what needs to occur during the ‘transition period’.

ASIC states the following on the transition period: As a fee recipient, you must give the client an FDS between 1 July 2021 and 30 June 2022 for an existing ongoing fee agreement; and the day that you provide the client with an FDS during the transition period will become the anniversary day for that arrangement in each subsequent year.

An FDS provided during the transition period must cover information for: (a) the previous year – a 12-month period that ends just before the transition day for the ongoing fee arrangement; and (b) the upcoming year – a 12-month period that begins on the transition day for the arrangement.

ASIC also offers an example, outlining situations where the 60-day notice period for the provision of FDSs occurs immediately before 30 June 2021. The guidance confirms that the FDS must include the 12 months of fees immediately before and after said agreement but also the period between when the last FDS was provided and the period covered by the new FDS.

9. Conclusion

It is imperative financial advisors are both aware of these amendments and are compliant with the corresponding provisions, prescribed forms of consent and renewal, and timeframes detailed within the OFA obligations.

For more information, please see ASIC’s regulatory resources on ongoing fee arrangements at: https://asic.gov.au/regulatory-resources/financial-services/giving-financial-product-advice/fees/faqs-ongoing-fee-arrangements/

Schedule 1 – Example written consent form (ongoing fees) and annotations

If you found this insight article useful and you would like to subscribe to Gadens’ updates, click here.

Authored by:

Matthew Bode, Partner

Chloe Parsons-Pope, Law Clerk

[1] section 962C of CA

[2] section 962A of CA

[3] section 962A(4) of CA

[4] section 962A(5) of CA

[5] see section 962B of CA

[6] sections 962F and 962FA of CA

[7] sections 962P, 1317E and 1317G of CA

[8] sections 962G, 962R, 962S, 1317E and 1317G of CA

[9] section 962H and 962K of CA

[10] section 962L of CA

[11] sections 962R and 962S of CA

[12] section 962R of CA

[13] section 962S of CA

[14] sections 962R(1)(c) and 962S(1)(c) of CA

[15] section 962R(4) and section 962S(5) and (8) of CA

[16] section 962S(2) of CA

[17] section 962U of CA

[18] section 962V of CA

[19] sections 1673B and 1673F of CA