APRA’s letter on the review of the prudential framework for groups

On Monday 24 October 2022, John Lonsdale, the APRA Deputy Chair, issued a letter to all APRA-regulated entities outlining a roadmap for the review of the prudential framework for groups. The letter supports APRA’s recent paper regarding modernising the prudential architecture, which was published on 12 September 2022.

The aim of APRA’s review is to ensure that the prudential framework is fit for purpose to be able to cater for the emergence and development of more complex corporate structures in the industry, resulting in the need for APRA to supervise more ‘groups’ of entities.

The group prudential framework has expanded over time. APRA first released its Level 3 groups framework in 2014, with its implementation commencing from 2017. APRA delayed the group capital components of the framework to allow for other contextually relevant domestic and international policy initiatives, including the ‘unquestionably strong’ bank capital reforms, to be first determined and finalised.

Objective of the review

The review’s main objective is to ensure that the financial safety of APRA-regulated entities within groups is not undermined by risks that are inherent in group structures. In particular, APRA will concentrate on:

- rationalising requirements for the management of risks associated with group structures (such as contagion risk generated by intra-group exposures and arrangements);

- promoting consistency in prudential requirements that apply to groups, so that the same risks are addressed in a consistent manner across all regulated industries; and

- providing clarity on group capital requirements and on APRA’s approach to regulating and supervising various types of group arrangements.

Scope of the review

Part of APRA’s scope is to make the framework for groups clearer and simpler to understand, as well as being in accordance with APRA’s strategic initiative to modernise the prudential architecture.

The prudential standards that apply to groups cover a range of key topics, including group governance, intra-group transactions and group risk management. The framework seeks to ensure that risks at the group level are well managed and mitigated, and the financial safety of APRA-regulated entities within groups is not undermined by group structures. Examples of these risks include the management of contagion risk and potential conflicts of interest.

Key prudential standards within scope of the groups review include:

| Themes | Key Prudential standards within scope of the groups reviews |

|---|---|

| Financial Resilience | 3PS 110 Capital Adequacy (draft) 3PS 111 Measurement of Capital (draft) |

| Governance | 3PS 310 Audit and Related Matters CPS 510 Governance – group requirements |

| Risk Management | 3PS 221 Aggregate Risk Exposures 3PS 222 Intra-group Transactions and Exposures CPS 220 Risk Management – group requirements |

| Resolution | CPS 900 Resolution Planning (draft) |

| Competition Issues | 3PS 001 Definitions and other industry definition standards as relevant |

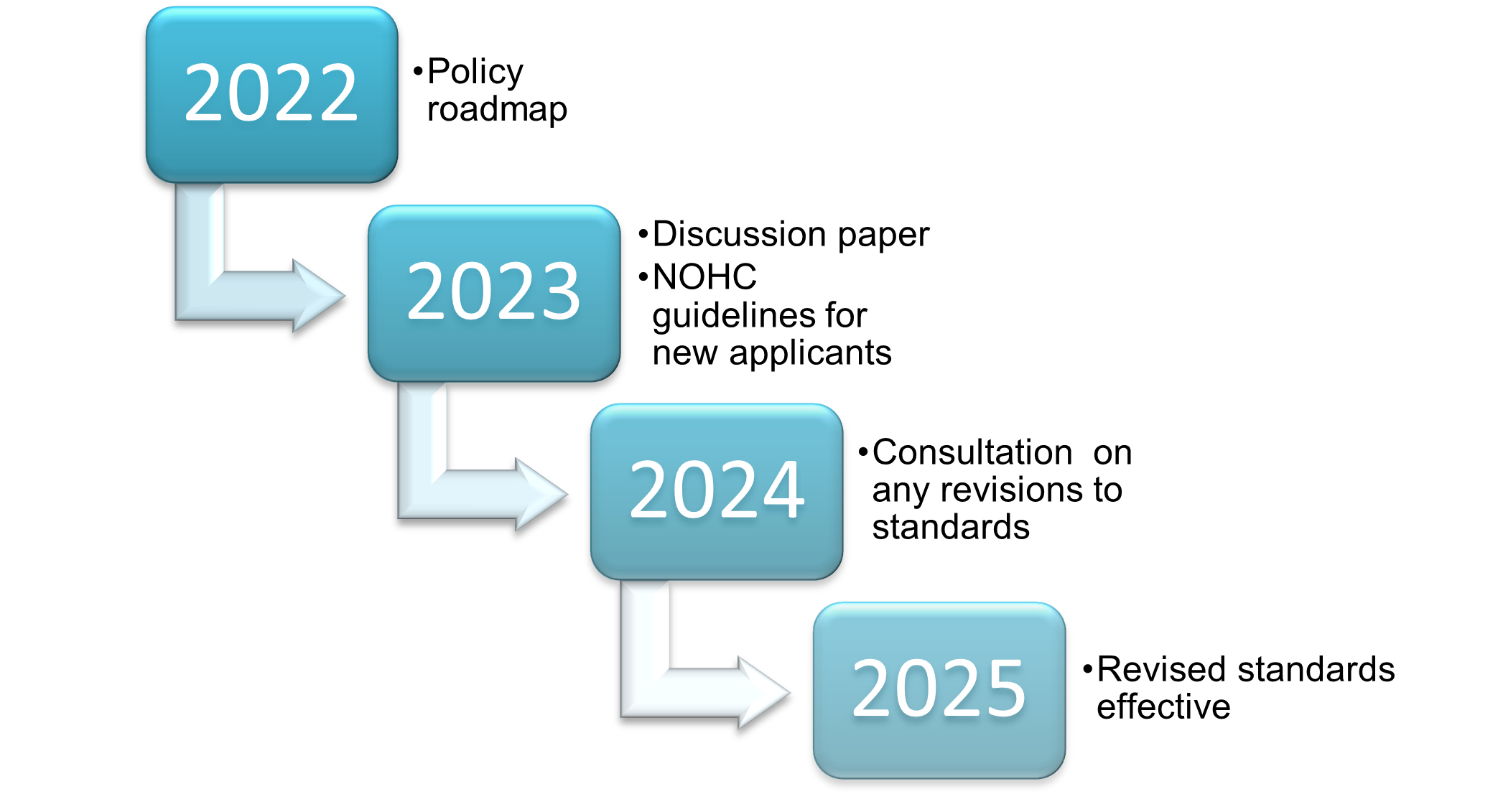

The review will occur over a couple of years, as outlined in the policy roadmap below, with any changes effective 2025:

There will be no immediate changes for all existing APRA authorised NOHCs. However, APRA will seek to ensure that any new or adjusted NOHC licence conditions are applied in a consistent manner as the framework review progresses.

If you found this insight article useful and you would like to subscribe to Gadens’ updates, click here.

Authored by:

Matthew Bode, Partner

Monty Frankish, Paralegal