New Infrastructure Contributions Plan system now in operation

The Victorian Government has introduced a new legislative framework for funding essential works and services in Metropolitan Greenfield Growth Areas under Part 3AB of the Planning and Environment Act 1987 (Act) and through the introduction of the Ministerial Direction on the Preparation and Content of Infrastructure Contribution Plans (Ministerial Direction). The Amending Legislation was introduced in June 2015 and came into effect on 1 July this year, but much of the detail at the time was left to be set out in the Ministerial Direction that was published on 20 October 2016.

Part A of the Ministerial Direction contains the Ministerial Direction on the Preparation and Content of Infrastructure Contributions Plans and Part B contains the Ministerial Reporting Requirements for Infrastructure Contributions Plans.

Partner Meg Lee and lawyer Linda Choi highlight the key features.

What are the key features?

The new system will operate under an Infrastructure Contribution Plan (ICP) which is the statutory document that forms part of the Planning Schemes where an ICP Overlay is in place. While initially foreshadowed to be applied in both Greenfield Growth Areas and in Strategic Redevelopment Areas, the “development settings” where the ICP will be applied initially are defined in Annexure 1 to the Ministerial Direction.

At present, this is limited to Metropolitan Greenfield Growth Areas which are defined as:

- a growth area declared under s46AO of the Act;

- within an urban growth boundary; and

- either:

- zoned for residential, industrial, commercial or Urban Growth Zone; or

- the subject of an amendment to the Scheme to be zoned as above.

An Infrastructure levy may consist of standard levy or supplementary levy or both.

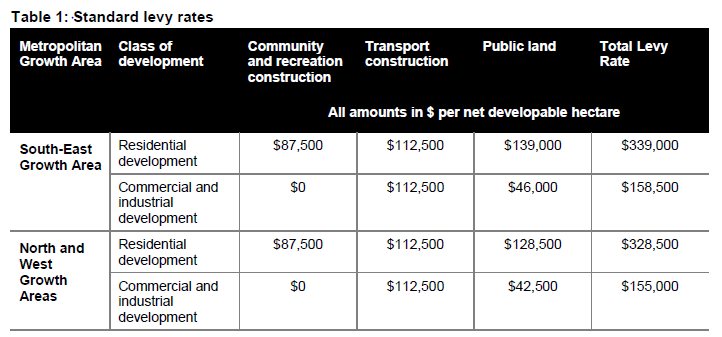

The standard levy applies to a Metropolitan Greenfield Growth Area and is designed to fund the construction of community and recreational facilities, transport infrastructure and for acquisition of public land for community and recreation facilities and transport infrastructure. The standard levy rates are set by the Ministerial Direction in Table 1 under Annexure 1 extracted below.

The supplementary levy is an optional levy which may be applied to fund infrastructure that cannot be adequately funded through a standard levy or that aids the growth opportunity of an area.

Table 2 of the Ministerial Direction Annexure 1 sets out the items that are allowable in the standard levy for community facilities and sports and recreation facilities. Tables 3 & 4 set out the transport items allowable in the standard and supplementary levies respectively. Tables 5 & 6 set out the items allowable for public land standard and supplementary levies respectively.

Other items that can only be funded by a supplementary levy are set out in tables 7 & 8 and include other local works not listed in the standard tables, financing costs and also State infrastructure (namely declared State roads, State schools and hospitals and land for regional open space).

What will this mean for developers and landowners in areas to which the new ICP system applies?

Developers and landowners need to be aware if their land is or will be affected by the introduction of an ICP in the relevant planning scheme. Once an ICP has been approved, developments which fall under the classes identified in Table 1 will generally be liable to the new standardised levy rates. The new system, therefore, makes the maximum total levy rate easy to calculate as well as transparent for all parties involved.

The system allows for some flexibility as the capped levies may be negotiated if all parties agree or the Minister consents. However, the new framework is not clear on what this negotiation will entail or how any proposed reduced or varied levies are to be assessed.

The new ICP system also allows the potential for developers to provide works-in-kind in lieu of part or whole of the infrastructure levy amount payable.

Transition into the new ICP system is made easier as existing Development Contributions Plans will continue to operate under the relevant planning scheme. Councils will also continue to have the ability to prepare new DCPs in areas where there will be no applicable standard levies under an ICP.