Digital asset regulation – Treasury’s proposed framework for regulating digital asset platforms

In the latest development in Australia’s regulation of digital assets, Treasury has released ‘Regulating Digital Asset Platforms’, a proposal paper for consultation (Proposal). The Proposal proposes to expand Australia’s existing financial services regulatory regime to fill the identified ‘regulatory gap’ in relation to certain digital asset custody services which are not financial products under existing law.

The Proposal follows Treasury’s ‘token mapping’ consultation earlier this year, which sought to define the essential concepts, functions, and features of arrangements in the digital asset sector, map the application of existing financial services laws to that ecosystem, and engage with industry about legislative reforms.

While the nature and scope of the proposed digital asset licensing framework will be refined as a result of the current Treasury consultation process, it is clear that many digital asset businesses that hold, or arrange the holding of, assets will have to be licensed in some form. These businesses are encouraged to participate in the consultation process and consider preparatory steps to meet likely Australian Financial Services Licence (AFSL) requirements.

The new resulting licensing framework is anticipated to come into effect in 2024.

Gadens provides an overview of the key aspects of the Proposal below.

Overview of the proposed framework

Digital asset facilities (DAFs)

The Proposal primarily focuses on expanding the existing financial services regulatory regime to capture service providers that hold digital assets or assets that back digital assets above a certain amount.

Critical to the Proposal is the anchor concept of ‘holding’ or custody of such assets, based on the concept of ‘factual control’ (ie possession). A ‘facility for holding digital assets and assets backing digital assets’ will be a ‘digital asset facility’ (DAF), which will be a new financial product.

The proposed reforms will primarily target digital asset holding arrangements that involve the DAF provider issuing ‘platform entitlements’ to clients (essentially rights of clients to receive assets or tokens held by the DAF provider or to direct the DAF provider to deal with them in certain ways).

The Proposal applies to both:

- ‘account-based systems’, where platform entitlements ‘flow to a specific person identified in a record’. For example, a digital currency exchange that does not assign separate wallets for each client, but rather holds all client assets in co-mingled wallets and facilitates ‘on-the books’ trades that do not involve corresponding on-chain transactions; and

- ‘token-based systems’, where platform entitlements ‘flow directly to any person holding a specific record’. For example, an asset backed token that represents the token-holder’s rights to the underlying asset.

So, anything from ‘on-platform’ and ‘brokerage’ style digital currency exchanges that record client entitlements via account-based records, to more complex blockchain arrangements where client tokens are deposited and a wrapped token or receipt token is issued to the client (eg wrapping contracts, staking-as-a-service protocols, and possibly ‘liquidity staking’ arrangements) are proposed to be captured.

However, the Proposal does not intend to capture ‘token-like’ systems such as electronic gift cards and event tickets delivered by email. This will be welcome news for many providers of such services who had raised concerns with the broad token-mapping exercise earlier this year.

Digital asset platforms (DAPs)

The simplest form of the proposed DAF is a basic custody-style facility. However the Proposal also captures the concept of a ‘digital asset platform’ (DAP), defined as ‘a multi-function platform comprised of a digital asset facility with additional administrative or transactional functions’.

The Proposal covers the following arrangements:

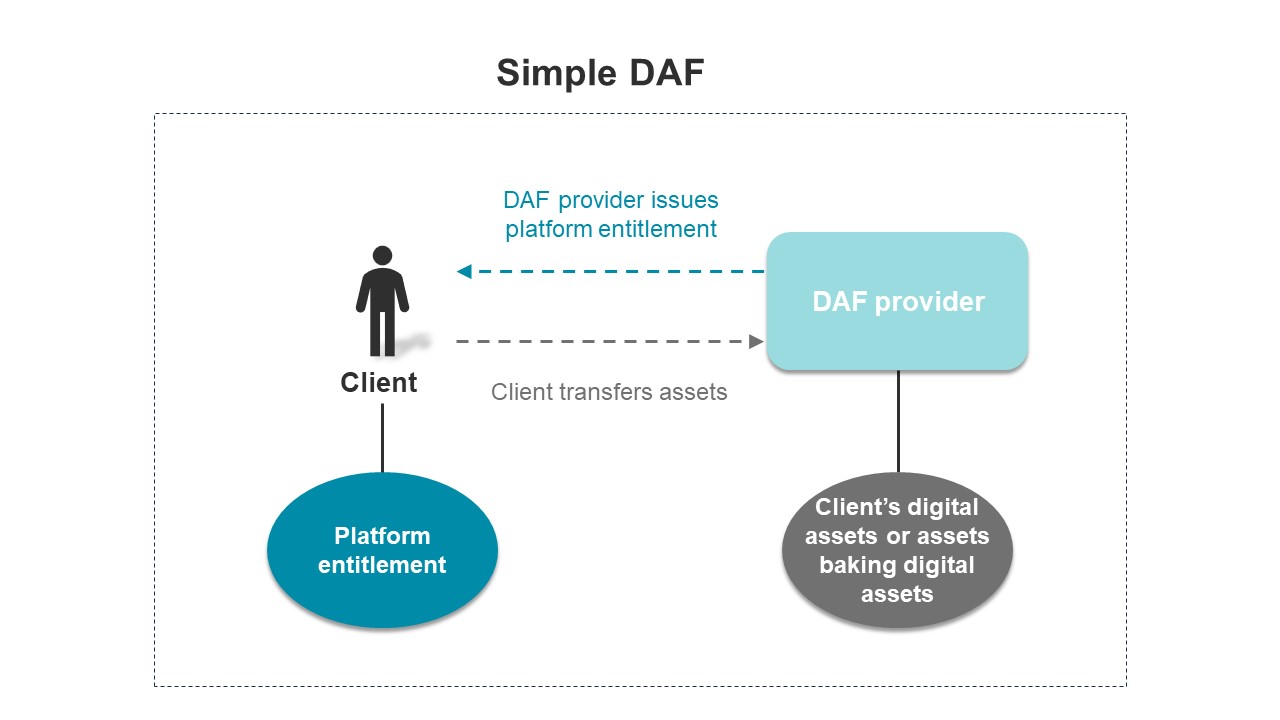

- Simple DAF: a simple digital asset holding arrangement with only basic functions that allow transfers of assets on and off platform would be a DAF but would not be a DAP. A simple DAF would not have a ‘financialised function’ (explained further below), such that platform entitlements could be exercised against the DAF provider, but not transferred (ie traded);

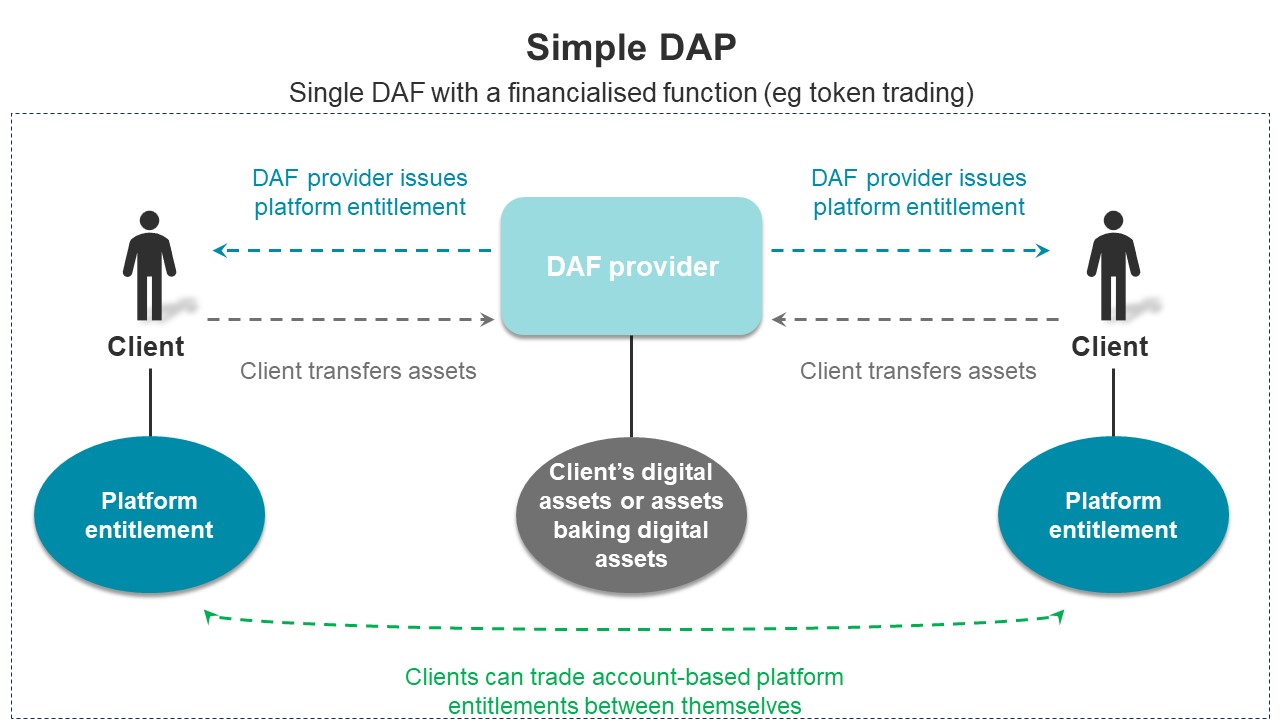

- Simple DAP: a DAF with greater administrative and transactional functionality than a simple DAF, such as any of the four proposed ‘financialised functions’;

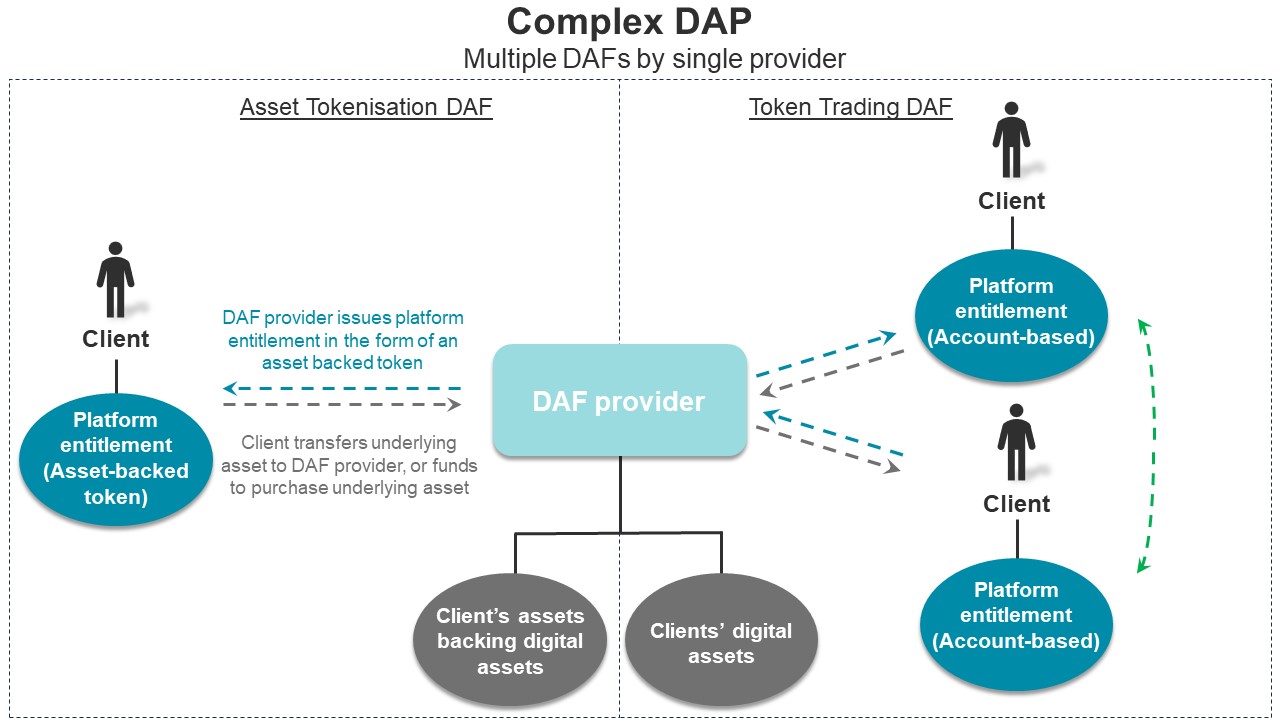

- Complex DAP: a DAP that involves multiple DAFs with additional functions (eg an account-based trading facility with a staking-as-a-service facility), issued by the same DAF provider; and

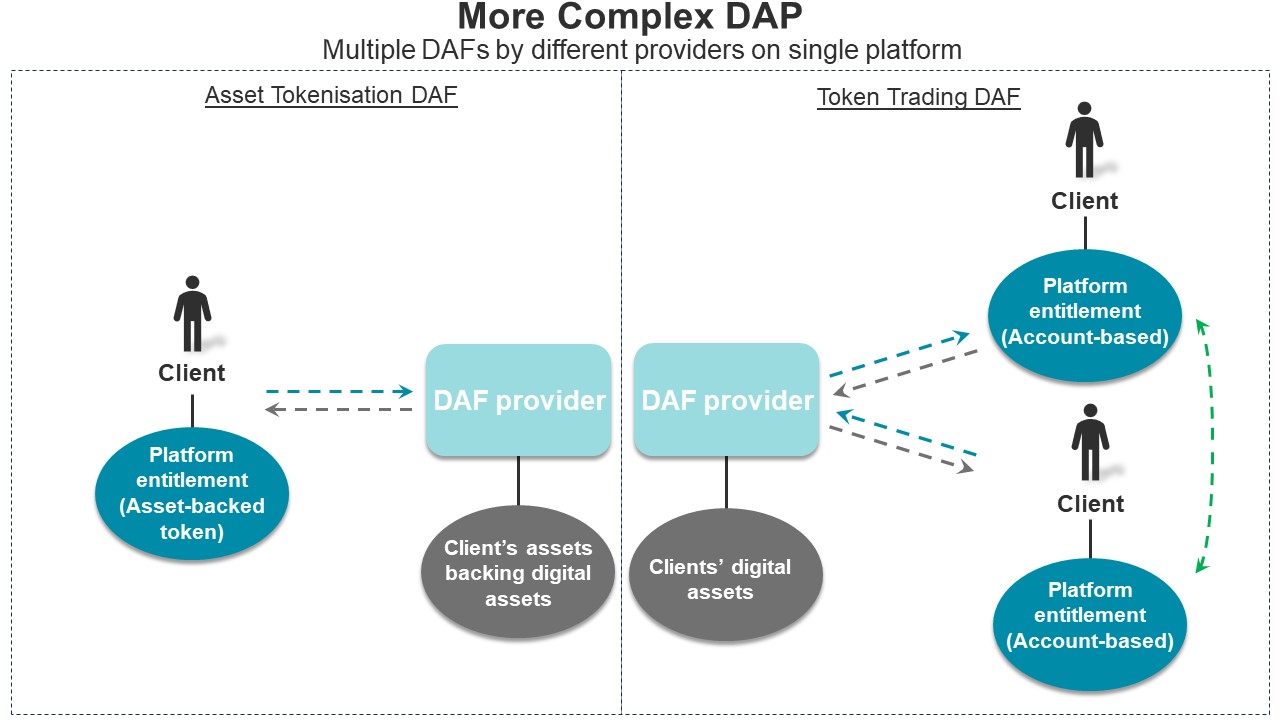

- More Complex DAP: a complex DAP where various DAFs are issued by different DAF providers.

We set out below diagrammatic representations of these possible DAF and DAP arrangements.

Proposed low-value exemption

The AFSL requirement will not apply where a DAF provider can rely on a proposed ‘low-value’ exemption where:

- the total value of each particular client’s asset entitlements against the DAF provider do not exceed $1,500 at any one time; and

- the total amount of assets held by the DAF provider do not exceed $5 million (in aggregate) at any time.

This reflects a similar ‘low value’ exemption available for non-cash payment facilities, and is ostensibly intended to promote innovation and early stage product experimentation, principally by enabling start-ups and emerging technology businesses in the space to first demonstrate a minimum viable product before having to undertake the onerous task of obtaining an AFSL.

Disclosure obligations

Under the Proposal, all DAF providers not falling within a licensing exemption will be subject to a broad suite of compliance obligations, including the general obligations that apply to all AFSL holders, as well as requirements to:

- Facility Guide: (if the DAF has any retail clients) disclose certain information in a ‘facility guide’ that must also meet the requirements of a financial services guide. Full disclosure of all information a person would reasonably require for the purpose of making a decision (as a retail client) to become a client must also be made on the DAF provider’s website. Where multiple DAFs are combined into a single DAP, the Proposal suggests that each DAF would need its own facility guide;

- Facility Contract: have a standard form ‘facility contract’ with all users of the facility (retail and wholesale clients), that meets certain ‘minimum standards’ relating to:

- holding and safeguarding assets (both tangible and intangible);

- issuing and administering platform entitlements in relation to DAFs, and rights for clients to exercise those entitlements;

- facilitating ‘transactional functions’ (eg financialised functions), including non-discretionary rules and arrangements and requirements for the DAF provider to notify ASIC if it has reasonable grounds to suspect that a person has engaged in market misconduct or similar conduct, and to take reasonable efforts to identify, prevent, and disrupt that misconduct; and

- to the extent that the DAF is part of a DAP that provides transactional functions, set out clear documentation outlining the systems, policies and procedures for making tokens available through the platform, as well as disclosing certain information about those tokens.

Financialised functions

The Proposal incorporates a new concept of ‘financialised functions’.

There are four proposed financialised functions, which are intended to capture arrangements that, in effect, ‘financialise’ non-financial products, and impose additional compliance obligations. For example, while a painting is not a financial product, the Proposal suggests that consumer protections should apply to a platform that facilitates the tokenisation of paintings and a marketplace for trading of those tokens (ie dealing with a non-financial product asset in a financialised way).

A summary of the four proposed financialised functions is set out in the table below.

| Category | Details | Minimum standards |

|---|---|---|

| Token trading | ‘Intermediating the exchange of platform entitlements between account holders’. A simple example would be where an ‘in-house’ digital currency exchange facilitates trades between clients based on an internal ledger of client entitlements, without any corresponding ‘on-chain’ transactions. |

|

| Token staking | ‘Intermediating an account holder’s participation in validating transactions on a public network’. A simple example would be where a digital currency exchange provides staking-as-a-service arrangements. |

|

| Asset tokenisation | ‘Intermediating the creation and exchange of platform entitlements backed by tangible and intangible non-financial product assets’. An example would be where a platform facilitates tokenisation of wine for a winemaker, where the platform takes custody of the wine (although the product may still be cellared by the winemaker under a service agreement), and the platform issues asset-backed tokens on-chain representing entitlements to the custodied wine products. |

|

| Funding tokenisation | ‘Intermediating the sale of entitlements to fund the development of ‘non-financial’ products and services’. At a very high-level, this category covers platforms that facilitate tokenised crowdfunding. For example, a blockchain version of a crowdfunding platform like Kickstarter, where interested parties can commit funds towards development of products, with funds released to the project developers at certain milestones. |

|

We understand from the Proposal that each financialised function in a DAP will need to be issued as its own DAF, and have its own Facility Guide and Facility Contract. For example:

- where a DAP offers both token trading and staking-as-a-service, each of these financialised functions will need to be treated as a separate DAF with its own Facility Guide and Facility Contract;

- a DAP that tokenises art and wine will need a separate Facility Guide and Facility Contract for each type of asset, although it is unclear whether separate Facility Guides and Contracts would also be required for each subclass of asset, eg each artist collection, or each winery collection; and

- a tokenised crowdfunding DAP will need to issue a separate Facility Guide and Facility Contract for each separate instance of crowdfunding, as well as satisfy the specific additional obligations.

Conclusion

Although the precise scope, application, and obligations of the proposed new framework are yet to be ironed out through industry consultation and later exposure draft legislation phases, it is clear that digital asset businesses holding client assets above a relatively low monetary threshold will need to hold an AFSL, and comply with additional minimum standards where they incorporate a financialised function.

From a regulatory perspective, the Proposal represents the first concrete step in digital asset regulation.

Gadens looks forward to contributing to the consultation process, and welcomes early engagement by any digital asset businesses considering their potential obligations under the Proposal and proposed reform.

If you found this insight article useful and you would like to subscribe to Gadens’ updates, click here.

Authored by:

Caroline Ord, Partner

Patrick Simon, Associate